Table des matières

Présentation du salon HVAC Expo 2025 de Varsovie

Le Warsaw HVAC Expo 2025 – SALON INTERNATIONAL DU CVC Le salon « CVC Expo » de Varsovie s'annonce comme l'un des événements les plus importants du secteur du chauffage, de la ventilation et de la climatisation (CVC), qui se tiendra dans la capitale polonaise. Le secteur du CVC joue un rôle essentiel pour garantir le confort et l'efficacité énergétique des bâtiments résidentiels, commerciaux et industriels. Face à la demande mondiale croissante de solutions écoénergétiques et de systèmes écologiques, des événements comme le Warsaw HVAC Expo sont essentiels pour présenter les innovations et favoriser les échanges entre les leaders du secteur, les fournisseurs et les professionnels.

Au cœur de l'événement se trouvera le dernières avancées en matière de technologie CVC, en mettant l'accent sur la durabilité, l'efficacité énergétique et les solutions d'énergies renouvelables. Alors que l'Europe s'efforce d'atteindre des objectifs environnementaux ambitieux, la demande de solutions CVC innovantes croît rapidement. L'édition 2025 mettra non seulement en lumière les acteurs clés du secteur CVC, mais abordera également la transition croissante vers les technologies vertes, notamment pompes à chaleur et systèmes de qualité de l'air.

À quoi s'attendre du salon HVAC Expo 2025 de Varsovie

Les participants peuvent s'attendre à vitrines de produits de pointe, des démonstrations interactives et tables rondes éclairantes. Le Salon HVAC de Varsovie 2025 sera le rendez-vous des leaders mondiaux des technologies CVC, des solutions énergétiques et des systèmes durables. Que vous soyez fabricant, distributeur ou prestataire de services, ce salon offrira des opportunités de réseautage inégalées.

Lieu et dates de l'événement

L'événement se tiendra dans l'un des plus importants parcs d'exposition de Varsovie, stratégiquement situé au cœur de la ville. Les dates sont fixées pour 25 – 27 février 2025, garantissant que le salon coïncidera avec le pic d'activité des secteurs du CVC et de la construction. Le lieu proposera des halls d'exposition spacieux, des salles de réunion ultramodernes et divers espaces de réseautage.

Principaux exposants et participants

Attendez-vous à voir des géants de l’industrie et principaux fabricants de systèmes CVC, de technologies de chauffage, de climatisation et de solutions de ventilation. De plus, les entreprises spécialisées technologies vertes, comme l'énergie solaire et les pompes à chaleur, joueront également un rôle important lors du salon. Les professionnels pourront rencontrer des experts internationaux, échanger des idées et découvrir les dernières tendances.

Thèmes et innovations

Les principaux thèmes du Warsaw HVAC Expo 2025 tourneront autour efficacité énergétique, solutions de construction durables, et le l'avenir des technologies CVC. Innovations dans systèmes CVC intelligents, avancé technologies de pompe à chaleuret les systèmes de construction écologiques occuperont une place centrale. Les participants pourront découvrir les dernières avancées en matière d'automatisation, de numérisation et Systèmes CVC pilotés par l'IoT.

Opportunités de réseautage

L'un des points forts du salon Warsaw HVAC Expo 2025 est l'opportunité de réseauter avec des professionnels du secteur du CVC. L'événement proposera des ateliers organisés. jumelage d'affaires, des tables rondes et un éventail de ateliersCes opportunités de réseautage sont inestimables pour créer des partenariats, acquérir des connaissances sur le marché et comprendre les tendances mondiales de l’industrie.

Le marché polonais des pompes à chaleur : une croissance rapide

La Pologne est devenue l'un des marchés européens les plus importants pour les pompes à chaleur. Ces dernières années, le pays a connu croissance rapide dans l'installation de systèmes de chauffage renouvelables, particulièrement pompes à chaleur aérothermiques et géothermiquesAlors que la Pologne s'efforce de passer à des sources d'énergie plus propres et d'améliorer la qualité de l'air, les pompes à chaleur sont devenues une solution solution clé pour les besoins de chauffage résidentiels et commerciaux.

Aperçu du marché et tendances de croissance

En 2022, le marché polonais des pompes à chaleur a connu une croissance remarquable plus de 100% de croissance, ce qui en fait l'un des marchés à la croissance la plus rapide de l'Union européenne. À l'époque, environ un système de chauffage sur trois Une pompe à chaleur a été installée en Pologne, consolidant ainsi sa popularité auprès des consommateurs polonais. Les ventes de pompes à chaleur du pays se classent parmi les top cinq en Europe, et la taille globale du marché a bondi d'environ 12 000 unités en 2012 à plus de 200 000 unités en 2022.

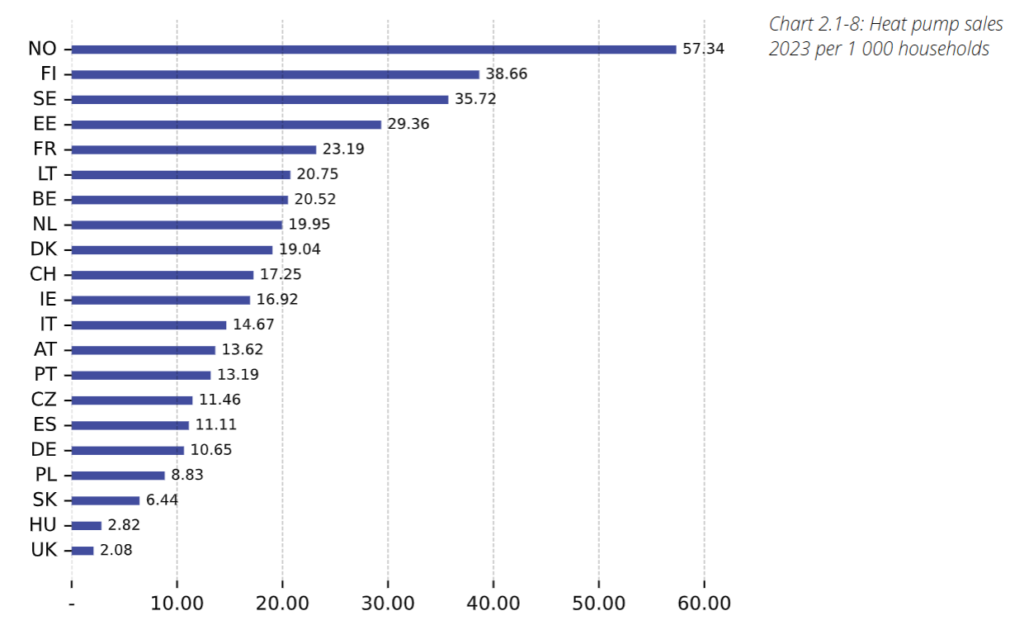

Part de marché et position en Europe

La Pologne est désormais un acteur majeur du marché européen des pompes à chaleur. En 2022, elle figurait parmi les top cinq pays en termes de volume de ventes, ce qui le place parmi les leaders aux côtés de l'Allemagne, de la France et de l'Italie. La croissance du marché polonais des pompes à chaleur est particulièrement importante alors que l'UE vise la neutralité carbone d'ici 2050. expansion du marché polonais des pompes à chaleur soutient ces objectifs européens plus larges.

Données de croissance et de ventes d'une année sur l'autre

En 2023, cependant, le marché polonais des pompes à chaleur a été confronté à une ralentissement important, avec des ventes en baisse de 38.8% par rapport à 2022. Le nombre total d'unités vendues en 2023 était 124,660, en baisse par rapport aux ventes record de l'année précédente. Ce ralentissement est largement attribué à facteurs économiques, les corrections du marché et les impacts de compétition internationale à partir de produits à bas prix et à faible efficacité, notamment en provenance de Chine.

Moteurs de croissance du marché polonais des pompes à chaleur

L’essor rapide du marché polonais des pompes à chaleur peut être attribué à plusieurs facteurs clés. moteurs de croissance, y compris favorables politiques gouvernementales, demande du marché pour des systèmes économes en énergie, et le plus large transition énergétique.

Politiques et soutien gouvernementaux

Depuis 2018, le gouvernement polonais a considérablement accru ses efforts pour promouvoir technologies d'énergie renouvelable, y compris les pompes à chaleur. Suite à réforme de la pollution de l'air, le gouvernement a introduit subventions et des incitations financières pour encourager les propriétaires et les entreprises à remplacer les systèmes de chauffage au charbon par alternatives plus propres comme les pompes à chaleur. La Pologne est l'un des rares pays européens où les subventions sont ajustées en fonction du revenu, ce qui en fait une option plus accessible pour un large éventail de consommateurs.

Évolution de la structure énergétique en Pologne

La structure énergétique de la Pologne dépend depuis longtemps de combustibles fossiles, en particulier le charbon. Cependant, suite à réglementations de l'UE et le besoin urgent de réduire les émissions, la Pologne a commencé à s'orienter vers des sources d'énergie durablesLes pompes à chaleur, qui s'appuient sur l'air ambiant ou température du sol pour fournir du chauffage, sont devenues un élément clé de cette transition. De plus, la guerre en Ukraine et la crise énergétique qui en a résulté ont entraîné la flambée des prix de l'essence, poussant davantage les consommateurs polonais vers alternatives plus propres comme les pompes à chaleur.

Impact post-invasion de l'Ukraine

Le Invasion russe de l'Ukraine en 2022 a déclenché un changement significatif sur les marchés européens de l'énergie. La Pologne, en particulier, a été confrontée l'escalade des coûts des combustibles fossiles, ce qui a conduit à une demande accrue de technologies d'énergie renouvelableLes consommateurs, dans le but de réduire leur dépendance à gaz naturel russe, a commencé à investir dans les pompes à chaleur et les systèmes d'énergie solaire. Cette crise géopolitique a accéléré le passage à solutions de chauffage plus propres, bénéficiant au marché des pompes à chaleur en Pologne.

Défis du marché polonais des pompes à chaleur

Malgré sa croissance impressionnante, le marché polonais des pompes à chaleur est confronté à plusieurs défis ce qui pourrait nuire à sa durabilité à long terme.

Lacunes réglementaires et politiques

Alors que le gouvernement polonais a introduit programmes de subventions pour les pompes à chaleur, il y a eu défis de mise en œuvre. Par exemple, le Programme Air pur, qui vise à réduire la pollution de l'air, a vu échappatoires dans la réglementation. Ces lacunes ont permis à certains importations chinoises contourner les normes d’efficacité strictes, ce qui suscite des inquiétudes quant à la qualité des pompes à chaleur vendues sur le marché.

Préoccupations économiques et du marché du travail

Le secteur des pompes à chaleur a également été impacté par facteurs économiques tels que l'inflation, les perturbations de la chaîne d'approvisionnement et pénuries de main-d'œuvreLe nombre d'employés dans l'industrie polonaise des pompes à chaleur a diminué de près de 10 000 travailleurs en 2023 en raison de l’instabilité du marché et de la concurrence des importations à bas prix.

L'avenir du marché polonais des pompes à chaleur

Malgré quelques contretemps en 2023, Le marché polonais des pompes à chaleur Le secteur de l'énergie présente encore un potentiel de croissance important dans les années à venir. Si le marché a rencontré des difficultés à court terme, les perspectives à long terme restent positives, le pays poursuivant sa transition vers des sources d'énergie plus vertes et plus durables. Plusieurs facteurs entrent en jeu. facteurs Les facteurs contribuant à cet optimisme sont notamment le soutien du gouvernement, les avancées technologiques et la sensibilisation croissante des consommateurs aux avantages des pompes à chaleur.

Projections du marché à long terme

À l’avenir, le marché polonais des pompes à chaleur devrait récupérer et grandir alors que le pays renforce sa sécurité énergétique et décarbone son secteur énergétique. Selon les prévisions de l'industrie, demande de pompes à chaleur devrait augmenter régulièrement, sous l'effet des politiques favorisant énergie renouvelable et des technologies écoénergétiques. D'ici 2030, le marché polonais des pompes à chaleur pourrait connaître un rebond significatif si le gouvernement met en œuvre de meilleures mesures de réglementation et d'assurance qualité.

De plus, Politiques au niveau de l'UE visant à atteindre la neutralité carbone jouera un rôle essentiel dans le façonnement du futur paysage énergétique de la Pologne. La Pologne devrait recevoir augmentation du financement de l'UE pour technologies énergétiques vertes, ce qui stimulerait l’adoption de pompes à chaleur et d’autres solutions renouvelables à travers le pays.

Potentiel d'amélioration des politiques

Pour que le marché prospère à long terme, il est essentiel de : raffinement des politiques et régulation du marchéLa Pologne doit veiller à ce que subventions et aides sont correctement administrés et que fabricants locaux sont protégés contre la concurrence déloyale. Le resserrement normes réglementaires L’importation de pompes à chaleur contribuerait également à garantir la qualité des produits disponibles sur le marché.

En outre, en abordant la question échappatoires dans les politiques existantes, telles que celles liées à la Programme Air pur—pourrait contribuer à uniformiser les règles du jeu pour les fabricants polonais de pompes à chaleur et à promouvoir une croissance durable dans le secteur.

Rôle dans la transition énergétique et la protection de l'environnement

Les pompes à chaleur joueront un rôle essentiel dans le développement plus large de la Pologne transition énergétiqueAlors que le pays cherche à éliminer progressivement le charbon et à réduire sa dépendance aux combustibles fossiles, les pompes à chaleur offrent une solution abordable et économe en énergie pour les particuliers et les entreprises. Leur capacité à exploiter les énergies renouvelables de l'environnement aidera la Pologne à atteindre ses objectifs. Objectifs climatiques de l'UE et contribuer à son durabilité environnementale.

Les pompes à chaleur sont particulièrement essentielles à la transition de la Pologne vers des systèmes de chauffage à forte intensité de carbone. Leur adoption généralisée réduira les émissions de gaz à effet de serre, aidant ainsi la Pologne à s'aligner sur ses engagements internationaux. engagements climatiques. De plus, leur efficacité énergétique peut réduire les coûts énergétiques des ménages et des entreprises, contribuant ainsi à résilience économique face aux fluctuations des prix mondiaux de l’énergie.

Aperçu du marché européen des pompes à chaleur 2024

Alors que le marché polonais a connu une croissance rapide ces dernières années, le marché européen des pompes à chaleur est confronté à des défis en 2024. Les ventes globales de pompes à chaleur à travers 13 grands pays européens devraient diminuer d'environ 23% par rapport à 2023. Cependant, ce ralentissement ne signale pas la fin de l'industrie des pompes à chaleur, mais reflète plutôt la corrections du marché et facteurs économiques impactant le secteur.

Tendances du marché et analyse des ventes

Selon le Association européenne des pompes à chaleur (EHPA), le nombre total de pompes à chaleur vendues en Europe en 2024 devrait atteindre environ 2 millions d'unités, en baisse par rapport à 2,6 millions d'unités en 2023. Le déclin des ventes peut être attribuée à plusieurs facteurs clés, notamment les changements dans incitations gouvernementales, l'incertitude économique et baisse de la confiance des consommateurs sur certains marchés.

Certains pays ont été plus durement touchés que d'autres. Par exemple, Belgique et Allemagne connaissent des baisses significatives de leurs ventes, avec baisses d'une année sur l'autre de 52% et 48%, respectivement. Ces chiffres reflètent le fait que programmes de subventions gouvernementales dans ces régions ont été soit réduits, soit restructurés, ce qui a entraîné une baisse d'intérêt de la part des consommateurs. En revanche, ROYAUME-UNI fait preuve de résilience, avec des ventes en croissance de 63%, en grande partie à cause de un soutien gouvernemental fort et une sensibilisation accrue aux avantages des pompes à chaleur.

Pays clés et différences de performance

Les 13 pays analysés par l'Association européenne des pompes à chaleur représentent environ 85% du marché européen total. Outre la Belgique et l'Allemagne, d'autres pays comme Danemark, Finlande, Italie, et Suède ont connu un ralentissement des ventes, bien que l'impact varie selon politiques nationales et conditions du marché.

En Pologne, la baisse est plus prononcée en 2023, en grande partie à cause de concurrence déloyale et pressions économiques. Cependant, la Pologne reste l’un des principaux marchés pour les pompes à chaleur, et le pays perspectives à long terme semblent toujours solides si les ajustements nécessaires du marché sont effectués.

Impacts sur le marché européen des pompes à chaleur

Le ralentissement du marché européen des pompes à chaleur peut être attribué à une combinaison de facteurs économiques et changements de politique gouvernementale. Le processus en cours crise énergétique mondiale, inflation, et hésitation des consommateurs ont conduit de nombreuses personnes à reporter leurs investissements dans les technologies renouvelables. Alors que le monde se remet des conséquences économiques de la pandémie de COVID-19 et de l'invasion russe de l'Ukraine, incertitude sur les futurs prix de l’énergie et les avantages à long terme des pompes à chaleur.

Facteurs économiques et confiance des consommateurs

Incertitude économique a freiné l'enthousiasme des consommateurs pour les nouveaux investissements dans les technologies écoénergétiques comme les pompes à chaleur. récession mondiale a affecté le pouvoir d'achat, en particulier dans les pays où les taux d'inflation sont élevés. prix du gaz Les prix restant faibles dans certaines régions d’Europe, de nombreux consommateurs ressentent moins l’urgence de passer à des systèmes de chauffage renouvelables.

De plus, le réduction des subventions gouvernementales et changements de politique Dans de nombreux pays, les variations des prix ont également contribué à la baisse des ventes. Soutien du gouvernement, qui a toujours été l’un des principaux moteurs de l’adoption des pompes à chaleur, est devenu plus imprévisible, ce qui rend les consommateurs moins disposés à s’engager dans des investissements aussi importants.

Modifications des prix de l'énergie et réductions des subventions

Un facteur majeur contribuant au déclin des ventes de pompes à chaleur en Europe est la baisse des prix du gaz naturel et du pétrole. Avec coûts énergétiques réduits Dans de nombreux pays européens, les consommateurs sont moins incités financièrement à opter pour les pompes à chaleur, qui nécessitent un investissement initial. De plus, réductions des subventions sur des marchés clés comme Allemagne et Belgique ont supprimé certains des avantages financiers qui faisaient des pompes à chaleur une option attrayante au cours des années précédentes.

Effets sur l'emploi et pertes d'emplois

Le ralentissement du marché européen des pompes à chaleur a eu un impact impact négatif sur l'emploi au sein de l'industrie. On estime qu'au moins 4 000 emplois ont été perdus en 2024 en raison d'une baisse des volumes de ventes et d'une demande réduite de pompes à chaleur. Cependant, malgré ce revers, Industrie du CVC continue de fournir environ 170 000 emplois directs dans toute l’Europe, démontrant ainsi son importance continue dans l’économie de la région.

Perspectives pour l'industrie européenne des pompes à chaleur

Au-delà de 2024, les experts restent optimistes quant à l’avenir du Marché européen des pompes à chaleurMalgré les défis actuels, il existe une forte conviction que le marché récupérer comme politiques gouvernementales évoluer vers une plus grande soutien aux technologies renouvelables.

Points de vue d'experts sur la reprise et les tendances futures

Paul Kenny, le Directeur exécutif de l'Association européenne des pompes à chaleur, estime que même si le marché connaît actuellement un ralentissement, il est loin d'avoir atteint son apogéeIl défend la L'UE va donner la priorité aux pompes à chaleur dans les cadres politiques à venir, en particulier dans le Accord industriel vert et Loi sur l'industrie à zéro émission nette, qui visent à stimuler la transition vers des industries durables à travers l’Europe.

Soutien politique et avancées technologiques

L’avenir du marché européen des pompes à chaleur sera probablement façonné par initiatives politiques et innovations technologiques. De nombreux experts estiment que technologies améliorées de pompes à chaleur, avec augmentation du financement gouvernemental, provoquera un rebond du marché. Les nouvelles technologies, notamment pompes à chaleur air-eau et pompes à chaleur géothermiques, sont susceptibles de devenir plus compétitifs en termes de coûts à mesure qu’ils mûrissent, ce qui favorisera encore davantage leur adoption.

Prévisions pour les 2 à 3 prochaines années

Les experts s'attendent à ce que Marché européen des pompes à chaleur faire l'expérience d'un forte reprise au cours des prochaines deux à trois ans. Sensibilisation accrue des consommateurs, combiné avec des politiques plus favorables, conduira probablement à demande renouvelée. Le L'engagement de l'UE pour atteindre neutralité carbone d'ici 2050 continuera de stimuler la demande de solutions de chauffage propres comme les pompes à chaleur, et leur part de marché devrait augmenter considérablement.

L'importance de l'industrie du CVC et des pompes à chaleur pour une croissance durable

En conclusion, le Salon HVAC de Varsovie 2025 jouera un rôle crucial en mettant en lumière les derniers développements dans le Industrie du CVC et solutions de chauffage renouvelables comme les pompes à chaleur. Le marché polonais des pompes à chaleur a connu une croissance rapide ces dernières années et, malgré les difficultés récentes, les perspectives à long terme restent positives. Alors que l'UE continue de faire pression pour énergie durable solutions, les pompes à chaleur seront à l’avant-garde de cette transition.

Assister à la Salon HVAC de Varsovie 2025 fournira aux professionnels de l'industrie des informations précieuses sur l'avenir des technologies CVC, le rôle des pompes à chaleur dans le secteur européen transition verte, et les opportunités potentielles de croissance dans les années à venir.

FAQ

1. Qu'est-ce que le salon HVAC Expo 2025 de Varsovie ?

Le Warsaw HVAC Expo 2025 est une exposition majeure dédiée à la présentation des dernières innovations dans l'industrie du CVC, en mettant l'accent sur les technologies écoénergétiques et durables, notamment les pompes à chaleur et les systèmes de climatisation.

2. Qui devrait participer au salon HVAC Expo 2025 de Varsovie ?

Les professionnels de l’industrie, y compris les fabricants, les distributeurs et les prestataires de services du secteur CVC, ainsi que les représentants du gouvernement et les investisseurs, devraient assister à l’événement pour réseauter et découvrir les dernières technologies et tendances.

3. Quelles nouvelles technologies seront présentées au salon HVAC Expo 2025 de Varsovie ?

L'Expo présentera les dernières innovations en matière de technologie de pompe à chaleur, systèmes CVC intelligents, et solutions écoénergétiques qui s’alignent sur les objectifs mondiaux de durabilité.

4. Quel sera l'impact du salon HVAC Expo 2025 de Varsovie sur le marché des pompes à chaleur en Europe ?

L'Expo offrira une plateforme de réseautage et de partage de connaissances, permettant aux professionnels du secteur de rester à l'avant-garde des tendances et des évolutions politiques. Elle mettra également en lumière les opportunités de croissance dans le secteur. Marché européen des pompes à chaleur, qui devrait rebondir dans les années à venir.

5. Quelle est l’importance des pompes à chaleur dans la transition énergétique de la Pologne ?

Les pompes à chaleur sont au cœur de l’abandon des combustibles fossiles en Pologne, contribuant ainsi à réduire les émissions, réduire les coûts énergétiques et promouvoir énergie propre solutions alors que le pays s'efforce d'y parvenir neutralité carbone.